Table of Contents

ToggleIntroduction

Wealth management is an important component of financial planning that needs experience and knowledge. Enrolling in one of the various wealth management courses available in India is the ideal method to get this information and competence.

You can gain the fundamental knowledge needed to manage your own money or those of others by enrolling in one of these courses. You can manage your financial destiny and achieve long-term success if you follow the proper path.

Consider enrolling in some of the top wealth management courses offered in India if you’re interested in a career in the same or simply want to increase your knowledge of personal finance. It’s an investment that will yield returns for many years!

What is Wealth Management?

Wealth management is a specialized field that helps individuals or families plan and manage their financial assets. The process involves creating personalized investment strategies to optimize wealth creation, preservation, and distribution. Wealth managers work closely with clients to identify long-term financial goals such as retirement planning, tax optimization, and Estate planning.

The primary goal is to provide personalized solutions that meet the unique needs of each client. A Wealth Manager will analyze a client’s current financial situation, risk tolerance level, and desired objectives before developing tailored solutions.

Wealth Managers offer a range of services including investment advice, asset allocation recommendations, and portfolio management services. They also guide various aspects of personal finance such as insurance planning, taxation issues, and trust formation.

The main objective of Wealth Management is to help clients achieve their life goals by maximizing the value of their investments while minimizing risks in an ever-changing market environment.

Benefits of Wealth Management

Financial planning must include wealth management since it has various advantages including:

- It makes sure that your funds are structured and well-organized to achieve your long-term goals. It aids in your decision-making when it comes to tax planning, savings, and investments.

- Wealth management services regularly assess the performance of your portfolio to make sure it is in line with your objectives. They will also make any modifications they think could be required due to developments in the market or your particular situation.

- Peace of mind is another key advantage of wealth management. Many people who may not have the time or skill needed for successful financial planning may find comfort in knowing that a professional is handling their finances and checking them regularly.

Wealth management offers complete financial advice that helps in building a solid financial future, among other benefits outside merely managing money well.

Also, read: Zero-based Budgeting Process

Different Types of Wealth Management

Wealth management is a broad field that encompasses various aspects of financial planning and investment strategies. Depending on one’s financial goals and the complexity of their portfolio, there are different types of wealth management services available.

One type is traditional wealth management, which involves customized guidance from a dedicated advisor who works with clients to develop personalized investment plans based on their individual needs and risk tolerance. This type of service typically includes ongoing monitoring and adjustments to ensure the plan stays on track.

Another type is robo-advisory services, which use algorithms to provide automated investment advice based on predetermined criteria such as age, income level, risk tolerance, and investment objectives. These services often have lower fees than traditional methods but may not offer the same level of customization or personal attention.

Family office services cater specifically to high-net-worth individuals or families with complex assets that require specialized expertise in areas such as tax planning, estate planning, and philanthropy.

Self-directed investing allows individuals to manage their investments through online brokerage platforms without assistance from an advisor. This option can be cost-effective for those who have experience in managing investments but may not be suitable for everyone.

Finding the right type of wealth management service depends on your financial situation and needs. It’s important to do your research before choosing a provider that aligns with your goals.

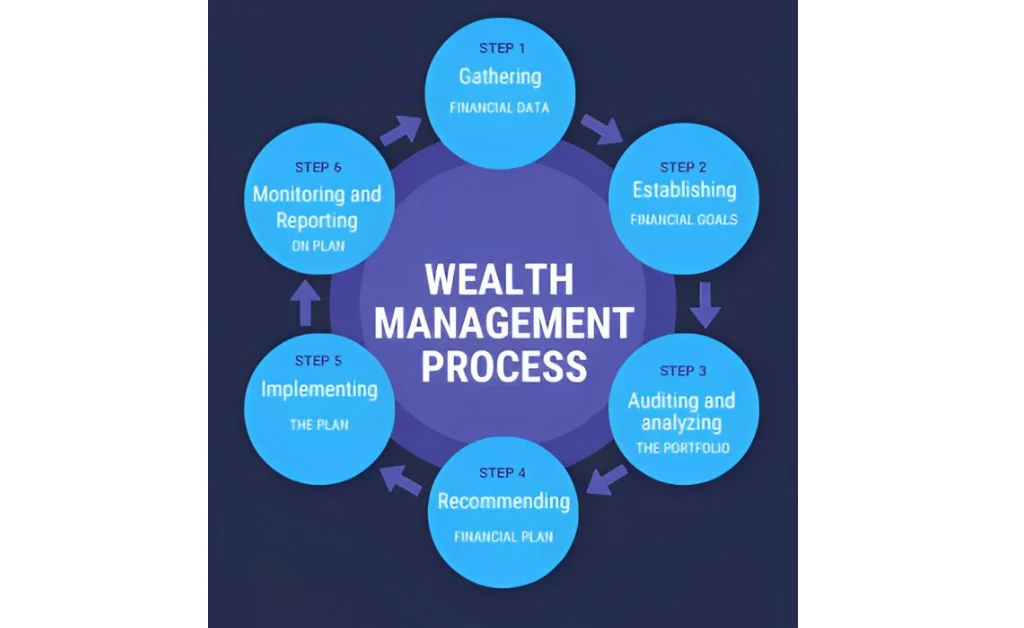

Wealth Management Process

Gathering Financial Data

The initial step in the wealth management process serves as the cornerstone for all subsequent steps. You can discuss your financial objectives, what you need from a financial adviser, and the kind of preparation you’ve done up to this point during this normally free, no-obligation consultation. This initial phase determines if the partnership will benefit you and the wealth manager.

Establishing Financial Goals

As much information as you can about your present financial situation, circumstances, and risk tolerance should be provided to your wealth manager. Give your financial advisor access to any recent statements, insurance information, and current assets so they may assess the overall worth of your estate, including policy values, terms, and benefits. By providing this information upfront, you may customize your planning approach to suit your particular needs.

Auditing and Analyzing the Portfolio

Your wealth management team evaluates your present approach and assesses what is working and what is not after receiving all of your information. To develop a revised plan, they will also consider the effects of any prospective adjustments. If you’re wondering why your wealth manager is so interested in learning about your risk tolerance and retirement plans, it’s because this information has a significant impact on your asset allocation model.

Recommending a Financial Plan

At this point, your financial advisor arranges a meeting with you to go through the outcomes of the earlier phases. They’ll describe the effectiveness of your existing investing approach, talk about potential adjustments, and you’ll create a portfolio and the best plan possible to help you reach your objectives together. Being truthful is crucial at every step, but it’s more crucial now. Your honest thought is required to guarantee that your financial adviser has all the data required to create a strategy particular to you and your objectives.

Implementing the Plan

Although the implementation stage itself entails a number of processes, this is where the finer points are ironed out. You will hear your wealth manager’s suggestions and share your own when you meet with them. Here is when your strategy comes into play. Then, your adviser may strive to ensure that your intentions are carried out precisely and on a timetable that suits you.

Monitoring and Reporting on the Plan

You will continue to work with your wealth manager as part of the process’ final stage, which involves frequent meetings. You and your adviser can decide on the frequency of these encounters jointly. Regular evaluations keep you informed of the status, effectiveness, and any new developments in your strategy. It’s also crucial to have access to a top-notch group of wealth managers between review sessions. Your team should be contacted if you have any changes or queries, and your adviser should get in touch with you as well.

Best Wealth Management courses in India

India is a hub for finance and wealth management, offering numerous courses to help individuals learn about handling finances. Here are some of the best wealth management courses available in India.

- The Chartered Wealth Manager (CWM) course offered by the American Academy of Financial Management India is one of the most respected courses in this field. It covers various aspects such as investments, financial planning, and portfolio management.

- NSE Academy’s Certified Wealth Manager (CWM) course is another popular choice among students. This program teaches topics like estate planning, risk analysis, and taxation laws related to investments.

- FLIP’s Wealth Advisor Program provides an extensive understanding of investment products such as mutual funds, bonds, and equities along with portfolio optimization strategies that include asset allocation techniques that help learners understand client-focused advisory services better.

- Indian Institute of Management Ahmedabad offers its Post Graduate Programme in Management – Securities Markets (PGP-SM). The course includes subjects like equity research & valuation modeling along with derivative pricing methods that are designed to create experts in capital markets & wealth creation.

These programs offer well-rounded education regarding present market conditions alongside preparing candidates for future challenges within their respective fields.

Career Paths in Wealth Management Industry

Portfolio Manager

The Portfolio manager’s job is to make investment decisions

Portfolio Managers are classified into several categories:

- Portfolio Manager for Stock Trading

- Growth Portfolio Manager

- Income Portfolio Manager

Analytical decision-making, communication, proactive, and agility abilities are essential for portfolio managers.

Relationship Manager

The Relationship Manager’s duty is to cultivate client and customer connections.

Fluency in communicating, listening skills, problem-solving abilities, and sales and negotiating skills are necessary for a relationship manager.

Investment Counselor

The function of the investment Counsellor is to give financial advice and counseling to customers.

Furthermore, they educate customers on the numerous investment products and services that would help them accomplish their financial objectives and goals.

Financial Advisor

The Financial Advisor’s role is to advise clients on a variety of financial issues, both short-term and long-term.

Financial counseling is mostly concerned with investments, taxes, and insurance.

The duties and responsibilities include doing market research and analysis, as well as suggesting and implementing plans.

Business Development Manager

The business development manager’s primary responsibilities include generating leads, projecting sales income, and negotiating client prices. Most notably, their function is to assist organizations in increasing their revenues.

Organizational skills, negotiating skills, problem-solving abilities, communication skills, and technical skills are all necessary.

Financial Analyst

The financial Analyst is in charge of monitoring the company’s financial strategy. They are also in charge of forecasting the company’s future performance and analyzing financial documents.

It also involves budgeting and capital structure modeling.

Critical thinking, financial literacy, accounting abilities, technological skills, and managerial skills are essential for every financial analyst.

Factors to consider while choosing Wealth Management Courses

When it comes to choosing the Best courses in India, there are a plethora of options available. However, selecting the right course can be a daunting task for many as each course has its own set of benefits and limitations.

- It is important to consider your background and current expertise level in finance before enrolling in any particular course. If you are new to this field, then starting with an introductory or beginner-level course would be ideal. On the other hand, if you have some experience or knowledge about wealth management already, then opting for more advanced courses could help you enhance your skills further.

- Another factor that plays a significant role is based on your career goals and aspirations. If you want to pursue a career as a financial analyst or portfolio manager, then pursuing specialized courses related to these fields would be beneficial.

- Do not forget to research the credibility of the institution offering these courses and compare their curriculum with others before making any final decisions.

Choosing the best course depends on various factors such as your prior knowledge about finance, career objectives, and researching potential institutions thoroughly before enrolling.

Conclusion

After exploring the different types of wealth management and the best courses available in India to pursue a career in this field, it’s clear that there is no one-size-fits-all solution. Each individual has unique goals, preferences, and skill sets that will determine which path they should take.

Regardless of which course is chosen, the benefits of pursuing a career in wealth management are numerous. Not only does it offer financial stability and high earning potential but also provides opportunities for professional growth and helping clients achieve their financial goals.

By doing a thorough research and seeking guidance from professionals in the industry, anyone can find success in this rewarding field.

Frequently Asked Questions (FAQs)

It refers to the process of managing an individual’s financial assets and investments by taking into account their goals, risk tolerance, tax situation, and other relevant factors.

Effective Wealth Management helps individuals make informed decisions about their finances, achieve their financial goals and secure a comfortable future for themselves and their families.

There are several types of Wealth Management including investment planning, retirement planning, estate planning, tax planning, etc. Each type caters to specific financial needs and objectives.

Some of India’s top-rated Wealth Management courses include Certified Financial Planner (CFP), Chartered Wealth Manager (CWM), NISM Series-X-A: Investment Adviser Level 1 Certification Exam, etc.

The choice ultimately depends on your career aspirations, educational background, and personal interests. Researching each course’s curriculum structure can help you decide what suits your requirements better.