Table of Contents

ToggleIntroduction

Are you interested in a career in accounting? Do you like working with numbers and analyzing financial information? If so, the Chartered Accountancy (CA) program might be for you.

The CA program is a globally recognized program that includes Accounting, Auditing, Taxation, and Business planning. It provides students with the information and abilities necessary to succeed as professional Accountants or Auditors.

Candidates must pass three tiers of tests as well as meet specific work experience criteria to become a qualified Chartered Accountant. Practical training is also included in the program to offer hands-on experience in real-world circumstances.

CA Course: Who Should Pursue?

One of the most crucial things you should be aware of regarding the CA course is this. In order to finish your coursework and pass the exam without any difficulties, keep in mind that studying CA will require a lot of enthusiasm, commitment, study, and hard work.

Consider taking the CA course if you are one of the following students or candidates:

- Candidates should pick CA Course if they have a strong interest in accounting, auditing, and taxes.

- Candidates who hope to work in corporate finance after earning their CA designation.

- Candidates that want to work independently and are more interested in the finance and taxes industries.

- Candidates seeking a degree from a foreign institution.

CA Course: Eligibility Criteria

This is yet another key consideration if you choose to take a CA degree. The following are the qualifying requirements for the CA course:

- Candidates must have passed their class 12th and 10th exams from a reputable educational establishment.

- In addition, the students must achieve a minimum of 50% in their 12th grade.

- Candidates applying for CA courses do not face any age limits.

Qualities You Need to Be a Successful CA

If you want to be a successful CA, you must possess the following skills:

CA Course duration after 10th

The ICAI has also permitted provisional registration for students who wish to pursue CA after completing their 10th grade. The new ICA guidelines allow 10th-grade graduates to apply for CA Foundation on a temporary basis following their 10th-grade exams. This interim registration will become permanent once they pass the 12th-grade exam.

CA Course duration after 12th

Are you considering becoming a Chartered accountant? The duration of the CA Course is an important factor to take into account while deciding which option is ideal for you. This section of the blog will assist you in managing the path ahead by providing a summary of the CA course duration after the 12th.

The Foundation Course lasts for approximately 8 months and is designed to help you get an understanding of accounting and finance principles. You can go to the Intermediate level after finishing the Foundation Course, which takes 15 months to complete.

This level strengthens your conceptual understanding by covering more complex accounting concepts including taxation, auditing, economics, and financial management. The Advanced Integrated Professional Competence Course, which is the third part of the program, assists in developing your practical abilities.

For satisfying the criteria of the CA Course length after the 12th grade, practical training is also necessary in addition to classroom instruction. Students are given projects relating to their curriculum during this time that require them to apply accounting principles to situations that they could encounter in the real world. When all three phases are finished, certification examinations that assess the student’s capacity to put what they’ve learned into practice are used to gauge their expertise.

During the training time, you will be exposed to the audit and taxes areas, and you will go on industrial tours to get real-world experience. The Institute of Chartered Accountants of India (ICAI)administers certification exams that must be passed in order to complete each stage of the curriculum, including the Foundation, Intermediate, Final, and Practical Training.

It takes a minimum of four years to complete the Chartered Accountancy Course. If you successfully complete the program, you can obtain the CA title and work as a professional accountant in corporations or open your own company.

Also read: CA vs CFA, ACCA Salary

CA Course duration after Graduation

Although being a qualified Chartered Accountant (CA) has long been seen as a desirable professional option, the process can be difficult. The Direct Entry Scheme has made it simpler than ever for recent graduates and postgraduates to become a CA.

Since the CA course normally lasts four years and does not demand any post-qualification experience, graduates and postgraduates alike can enroll in it with ease. Exemptions may be granted for some paperwork, which will make things simpler and save time and effort. The time allotted for the CA course is split between the tests and the practical instruction.

With the Direct entry system, you can directly appear for the IPCC test without giving the CPT exam. However, if you have prior job experience in accounting or finance, you may be qualified for several course exemptions.

Finally, one of the best aspects of this method is that it is very adaptable to diverse demands and life circumstances. You may pause or extend your studies if necessary, as long as all criteria are met within seven years of acceptance to the Direct Entry Scheme.

To summarise, the Direct Entry Scheme has made becoming a Qualified Chartered Accountant easier than ever before. With a diligent and industrious attitude, one may easily complete the three-year course within the time limit specified.

Check out this and find what’s best for you- CS Course Duration

CA Course Details

It is important to remember the following points:

- A Chartered Accountant’s tasks include filing company tax reports, evaluating financial accounts, and providing financial advice.

- One significant advantage of taking a CA Course is that there is no age limit or limited number of tries.

- Any person of any age can attempt the course an unlimited number of times in order to pass it. After the 12th grade or after graduation, you can enroll in the course.

- Students who wish to pursue CA after graduation will be excluded from taking the initial CA admission exam. To get admitted to the course, you must achieve a certain percentage.

- Once you have passed the requisite levels, you must join Articleship for a set length of time to receive experience and advance.

- CA is referred to as a Certified Public Accountant or CPA in the United States, or the course taught is connected to finance and accounting, and there are several associations and regulatory organizations for CAs.

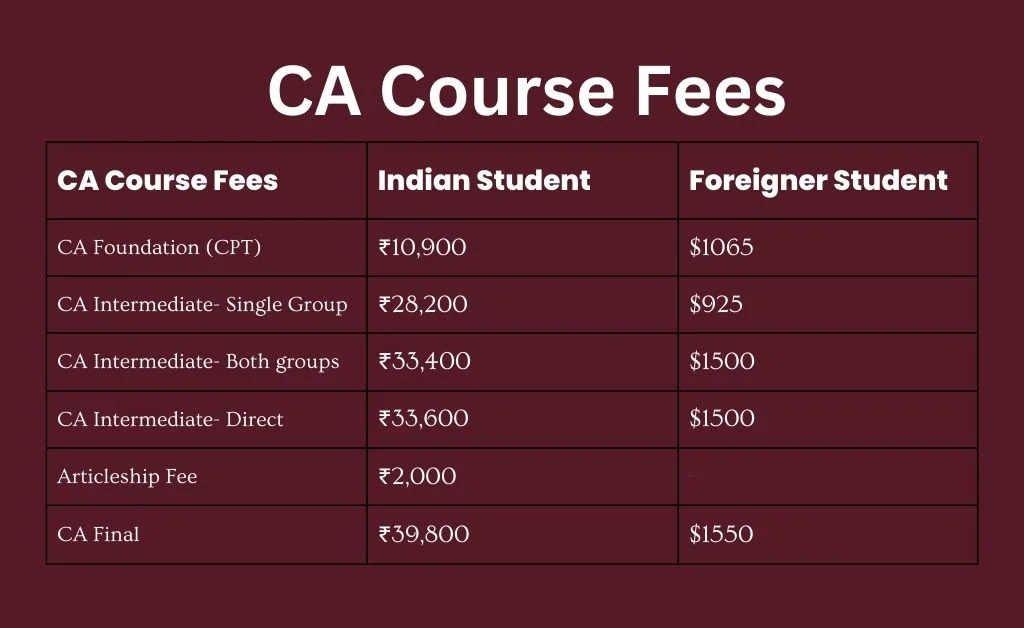

CA Course Fees

Conclusion

After going through the details of the CA course, it’s clear that this is a challenging yet rewarding career path to choose. The length of the course can initially appear difficult, but with commitment and effort, one can successfully finish it within the allotted time.

The thorough course material covers every facet of accounting and finance required for success in the profession. In addition, prerequisites such as a bachelor’s degree or equivalent qualification ensure that only serious candidates pursue the program.

While fees for pursuing a CA course can be expensive, there are various payment options available to ease the financial burden. Moreover, upon completion of the program, job opportunities abound in both private and public sectors.

Anyone looking for an exciting career in accounting should consider pursuing a CA certification. The journey may be challenging but ultimately worth it for those who persevere.

Frequently Asked Questions (FAQs)

The total duration of the CA course is around 4-5 years, which includes both theoretical education and practical training.

Yes, every student pursuing a Chartered Accountancy degree has to undergo three years of compulsory practical training called Articleship.

Students who have completed their Class XII exams from any recognized board or university can pursue this program. Additionally, they must also clear CPT (Common Proficiency Test).

The cost of enrollment varies depending on different factors such as coaching classes’ fee structure or self-study options opted by students.

After completion of a Chartered Accountancy degree students can work with accounting firms, banks, and financial institutions as well as start their consultancy services.