Table of Contents

ToggleIntroduction

If you are interested in a career in finance and risk management, learning about FRM Salary in India and abroad may be a wise decision. Due to its economic powerhouse status, India is in need of professionals who are knowledgeable about finance and risk management. Often, these amplified demands are reflected in the salaries of FRMs working in India.

The process of becoming an FRM requires specialized training and certifications. Although it is possible to become certified as an FRM without formal academic qualifications, employers prefer applicants with a degree or certification. This could take up to five years of study and testing.

An FRM’s employment functions and responsibilities are broad and complex, ranging from developing methods to limit risk in financial investments to developing strategies to maximize return on investment, they impact every aspect of business operation. The level of expertise comes with both professional challenges and rewards, so you need to be prepared to handle some tough demands while enjoying the benefits of such a respected position.

For those who are ready for the challenge, becoming an FRM provides plentiful chances for career advancement within India’s ever-shifting financial sector. Depending on qualifications, experience, and current role within the firm. FRM salary in India can vary from 3-10 lakhs per annum; nonetheless, salaries at senior levels may be much more than this! As well as a wage increase with time, you can expect promotional opportunities based on your work and extra pension entitlements from state plans such as NPS (National Pension Scheme).

Salary for FRM freshers in India

It is widely recognized that the FRM certification is the gold standard for evaluating risk management knowledge and expertise. Depending on the work market, the FRM salary in India for freshers is extremely competitive.

The job market in India tends to be more competitive in some cities than it is in others. FRM Salary in India are different in different cities, cities such as Mumbai, Delhi, Bengaluru, and Chennai tend to offer higher FRM salaries than others.

Generally, the financial services sector pays the highest FRM salary in India. If you are interested in a career in this field with exciting growth potential, consider working for large multinational banks.

You might just want to pursue an FRM certification if you’re a fresher looking for a good career start with an attractive salary package. Your earnings potential could be quite promising once you enter the Indian workforce after obtaining your certification, given your experience and knowledge within your field.

FRM salary for Experienced Professionals in India

FRM salary in India may vary depending on a variety of factors, including the type of industry or sector in which the FRM professional is employed, as well as the qualifications and certifications he or she possesses. Generally, an experienced FRM’s salary in India varies between Rs.5 and 10 lakhs per year.

Experience has a big impact on an FRM professional’s remuneration, and most firms will compensate employees based on their years of experience. FRM professionals with more than five-ten years of relevant experience usually earn more than beginners without or with little experience. When deciding on compensation for experienced staff members, employers may also consider the employee’s performance appraisal system.

Additionally, companies offer bonuses, stock options, health benefits, leave entitlements, and travel allowances to attract and retain experienced FRM professionals.

In addition to providing a good salary package, employers should also provide a conducive working environment where employees can develop professionally as well as receive remuneration in accordance with their expertise. A fair and objective performance appraisal must be conducted by employers in order to ensure that staff members perform at their peak potential at all times.

When an experienced FRM in India possesses the necessary qualifications and certifications, performs consistently well at work, and has conducive working conditions provided by their employer, the salary is quite good for their level of expertise.

You can also visit our other blogs: CA vs CFA

Top 10 companies that pay high salaries

- Tata Consultancy Services Limited (TCS): TCS pays FRM professionals well. The average FRM salary in India is over 8 lakh rupees per year across all levels of experience, making it one of the most attractive options for those looking to break into the field.

- Amazon India: It pays an FRM salary of 6 lakh rupees per year on average, making it one of the largest e-commerce operations in the country.

- Infosys: It offers competitive salaries for its FRM staff. The average FRM salary in India stands at 5.5 lakh rupees.

- Wipro: average annual FRM salary in India at Wipro is 5 lakh rupees once they have completed two years of service. Wipro provides various services like finance, information, and engineering and thus needs risk managers to mitigate the risks. Hence, the salaries here are very competitive for risk managers.

- Goldman Sachs: The Senior FRMs in India earn an Average Salary of Rs. 5-10 lakhs per year based on their experience and expertise. Performance-based bonuses and stock options may also be offered.

- Accenture: Depending on their risk assessment capabilities and other professional qualifications, qualified FRM salaries here range from 6-10 lakhs per year.

- BNP Paribas Group: This is another global bank with some of the best FRMs in India. They earn between 8-12 lakhs a year plus bonuses, health care, and stock options.

- JPMorgan Chase & Co: Asset management, private banking, commercial banking, and other services are among the specialties of JPMorgan Chase & Co. In India, the average annual salary of an FRM here is 8-15 lakhs, with bonuses for successful risk assessments and portfolio management strategies.

- Kotak Mahindra Bank: Its FRM salary in India ranges from 7-12 lakhs per year with attractive benefits such as health insurance, transport allowance, and paid holidays.

- Deloitte Consulting Services: It pays the FRM designation very well. Its FRM salary policy states that FRMs can earn up to INR 10 lakhs a year, or even more, based on their years of experience and role.

FRM Salary in India vs the United States

The FRM salary in India and the United States depends on a number of factors. According to experience and qualifications, the salary of an FRM in India ranges from 5 to 20 lakhs. FRM practitioners in the United States, on the other hand, earn substantially greater incomes, ranging from $100,000 to over $400,000.

The qualifications and experience required for Indian and US FRM positions differ. An MBA degree or equivalent is usually required in India, along with 13 years of experience. It usually takes 35 years of experience and a professional certification such as GARP (Global Association of Risk Professionals) to become an FRM in the US.

When housing costs and other expenses are taken into account, India’s standard of living does not necessarily differ much from the United States in terms of salaries and costs of living.

When it comes to resources available to guide professionals seeking a career in FRM, there are also some differences between countries. Although both countries offer ample educational resources for FRMs – universities, online programs, etc. Training programs are generally more accessible in the United States – for instance, paid workshops – than in India.

FRM Salary in India vs the UK

In the ever-evolving job market, knowing the different salary ranges and job market growth available in the field of Financial Risk Management is essential.

When comparing FRM salary in India and the UK, there are a few important factors to keep in mind. Over the past few years, the demand for qualified FRMs has steadily increased in both countries. Globalization has led to an increase in the demand for financial risk management services.

Depending on where you live, companies offering positions in this field require different skills and experience. In India, there is an emphasis on having a strong academic background with significant work experience. Companies in the UK, however, often give more priority to professional certifications such as GARP or CFA Institute FRM certifications.

Indian and UK working environments differ greatly in terms of job culture. Those who prefer a more relaxed atmosphere may find positions in India more suitable, whereas UK roles tend to have higher expectations placed upon workers with regard to competitiveness and productivity within their marketplace.

According to global economics, FRM salary in India and the UK are quite similar, even when the currencies of both countries differ. Approximately 600,000 INR (about 8500 GBP) is the average salary for a junior FRM salary in India, whereas approximately 1 million INR (about 14000 GBP) is the average salary for a senior FRM position.

Salary factors

It is important to understand how these factors will affect your salary package as a Financial Risk Manager (FRM) as you evaluate your career options. Experience, location, job role, firm size, education level, compensation package, industry experience, and performance evaluation may all play a role in determining your salary.

Experience and FRM salary in India are strongly correlated. FRMs with the most experience earn higher salaries than those without. The location of the company employed may also affect salary levels; for example, jobs in urban areas usually pay more than jobs in small towns.

The job role in India is another factor that affects FRM salaries. Generally, larger companies pay higher salaries than small companies because they have more financial resources and capabilities. In addition to their education level, an FRM’s salary can be influenced by their education level; higher education can lead to a higher-paying job and possibly higher wages in the future.

A company’s compensation plan can undoubtedly influence an FRM’s salary in India. Companies may differentiate themselves by offering bonuses or stock options, which could lead to greater financial incentives for employees and higher salaries overall. On top of this, industry expertise is also taken into account while assessing potential salaries; those who possess a specialized understanding of the industry tend to command higher wages since they are able to demonstrate more value to employers through their insight into sector trends and nuances.

The industry expertise that you possess plays a significant role in determining your FRM salary in India. Because they can clearly demonstrate their value to employers, those who have extensive knowledge and experience in the finance industry will be able to get higher salaries. If you already possess these skills and knowledge, you are more likely to be paid a higher salary than freshers because employers want to hire those who can demonstrate their skills and knowledge.

A positive performance evaluation will also impact FRM salary in India. Employers will want to reward hard-working and successful employees with a higher salary if their performance evaluation is positive. As a result of poor performance ratings or lack of output, you might receive lower pay than your peers if your performance evaluation isn’t up to par.

If you want to maximize your FRM salary in India, work on building up your industry experience as well as your performance profile. In this way, you will receive a higher salary and be respected by your peers as an expert in your field.

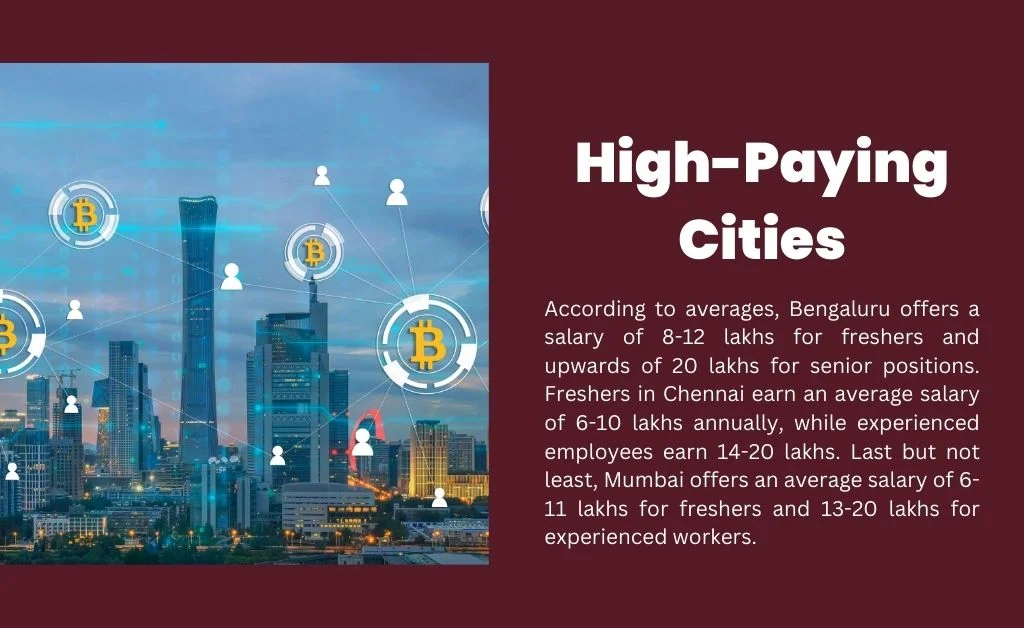

FRM Salary Levels in High-Paying Cities

We will examine the major cities with high salaries, the trend of salary growth over time, the average FRM salary in India gap between cities, and the variation in job roles and experience levels.

Among the top three cities in India offering high FRM salaries are-

- Bengaluru (Bangalore)

- Chennai

- Mumbai

As a result of their vibrant business environment and strong job market, these three metropolitan cities provide the highest average FRM salary in India. In addition, these cities have seen a steady rise in demand for FRMs over the past few years as companies increasingly seek to build up their risk mitigation capabilities.

According to averages, Bengaluru offers a salary of 8-12 lakhs for freshers and upwards of 20 lakhs for senior positions. Freshers in Chennai earn an average salary of 6-10 lakhs annually, while experienced employees earn 14-20 lakhs. Last but not least, Mumbai offers an average salary of 6-11 lakhs for freshers and 13-20 lakhs for experienced workers.

In addition to the role of the auditor (internal or external), the level of experience the employer requires (fresher or veteran), the benefits offered by employers (salary, bonus, stock options, etc.), the size of the industry, and the economic conditions of the city or region, the average may vary.

The benefits of becoming an FRM in India

If finance and risk management interest you, you might make a great candidate for an FRM as FRM salary in India are very lucrative. An FRM (Financial Risk Manager) identifies, analyzes, evaluates, and addresses the risks associated with business operations and investments. Obtaining an FRM certification in India has many advantages when it comes to minimizing losses and maximizing returns.

It is important to note that the salary potential for FRMs in India is significantly higher than for similar roles without the FRM designation. In India, becoming an FRM can lead to a highly successful financial career due to its high earning potential.

Aside from good compensation possibilities, having an FRM qualification provides other financial benefits such as bonuses, incentive payouts, and stock options. Any individual with this impressive degree will be more competitive in the market as it demonstrates a profound understanding of financial markets and the ability to respond proactively to crisis situations.

In addition, becoming an FRM provides employers with more job security because they know that they are hiring someone who is serious about risk management and knows how to price derivatives, manage portfolios, and rate credit – all essential skills for any business.

Obtaining an FRM designation will also give you a sense of professional accomplishment that is unattainable by pursuing a typical finance degree or certificate. Besides demonstrating your commitment to your field to employers, you’ll be able to access a wider range of employment opportunities as well.

Conclusion

In order to work in finance or risk management, it is crucial to obtain an FRM qualification. This certification not only provides vital knowledge and skills about global financial markets but is also the leading global qualification for risk professionals. Therefore, an FRM Salary in India and abroad is very high and they get more job opportunities.

When it comes to occupation prospects, the demand for FRM-qualified financial personnel is growing across all sectors. From banks to hedge funds, companies are searching for individuals skilled in risk management to assist in managing their assets as market conditions and regulations fluctuate. Technology too has revolutionized corporate operations, further increasing the need for professionals adept at controlling these risks effectively while keeping up with evolving trends.

Furthermore, as technology advances, so does the opportunity for individuals with FRM certifications, as well as the shifting environment of finance and risk management in India. Increasingly, organizations are using artificial intelligence (AI) and data analytics to identify risks and make informed investment decisions.

Employers looking to manage their investments effectively and reduce potential losses due to risk exposure from current or new projects will be highly attracted to FRM-qualified professionals with a deeper understanding of technology-based tools.

Frequently Asked Questions (FAQs)

While an MBA is a challenging two-year program that includes internships and tests, passing the FRM-accredited course is more laborious because it requires the entrant’s dedication and hard work, also FRM salary in India and abroad is good.

It does not only provide the essential skills but also the practical knowledge which is beneficial in financial growth and FRM salary in India is very good.

FRM salary in India and abroad depends on different level, Entry-level FRMs with less than three years of experience earn an annual pay of 4.2 lakhs. Those with 4-9 years of experience earn an average of 3.1 Lakhs per year, while those with 10-20 years of experience earn an average of 8.5 Lakhs per year.

There are two levels in FRM-

- Level 1

- Level 2

- Risk Analyst

- Credit Risk Analyst

- Regulatory Risk Analyst

- Operational Risk Manager

- Risk Manager

- Market Risk Analyst

- Chief Risk Officer