Biometric solutions are typically used for security and access control across businesses and government organizations. The U.S. government has taken keen interest in biometric applications and has been aggressively funding advanced research programs in businesses that offer biometrics.

The Intelligence Advanced Research Projects Activity (IARPA), a U.S. government organization that funds academy and industry research, announced the launch of the Odin program in October 2017. Odin aims to develop biometric presentation attack detection technologies to better identify unauthorized user attempts and imposters. IARPA’s other programs such as Biometrics Exploitation Science & Technology and Janus also aim to “significantly advance biometric technologies.”

In April 2017, IARPA awarded AI biometric solutions provider Crossmatch a contract of $5.8 million to “develop next-gen biometric presentation attack detection technologies.” In June 2017, it funded a four-year $12.5 million contract to SRI International, an independent, nonprofit research center to “address vulnerabilities in the current biometric security systems,” specifically, fingerprint, iris and face scanners.

Biometric technology has captured the interest of many investors outside of IARPA as well. SenseTime, a Chinese AI company that offers a range of AI business solutions, including biometrics says it set a record by raising $410 million in July 2017.

How AI Biometric Technologies Work

There are two categories of biometric identification and recognition solutions: Physical and behavioral.

Physical biometric solutions use distinctive and measurable characteristics of particular parts of the human body, such as a person’s face, iris, DNA, vein, fingerprints, etc., and transform this information into a code understandable by the AI system.

Behavioral biometric solutions operate in a similar way, except they use unique behavioral characteristics, such as a person’s typing rhythm, way of interaction with devices, gait, voice, etc. This encoded biometric information is stored in a database and digitally sampled during authentication and verification.

Face Recognition

A facial recognition biometric system identifies and verifies a person by extracting and comparing selected facial features from a digital image or a video frame to a face database. For example, an algorithm may analyze the distance between the eyes, the width of the nose, the depth of the eye sockets, the shape of the cheekbones, the length of the jawline, etc., and encode the corresponding data as “face prints,” which can then be used to find appropriate matches in a destination database.

Speaker (Voice) Recognition

Speaker or voice recognition differs from speech recognition in that the former recognizes and identifies a speaker using voice biometrics and the latter analyzes what is being said. Voice biometrics include both physical characteristics, such as the shape of the vocal tract responsible for articulating and controlling speech production, and behavioral characteristics such as pitch, cadence and tone, etc.

Voice biometric solutions digitize words by reducing them to segments comprising encoded frequencies or formants and produce a model “voice print” unique to a person. This voice print is used for identification and authentication of the speaker. Our previous coverage on natural language processing has explored voice recognition in greater depth.

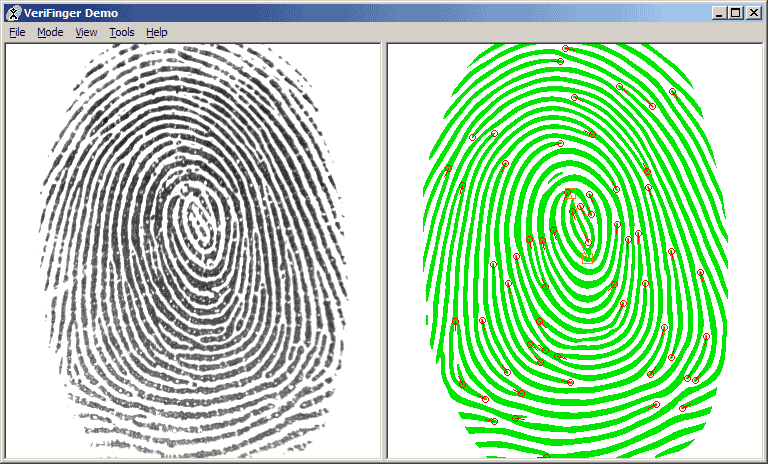

Fingerprint Recognition

Most fingerprint biometric solutions look for specific features of a fingerprint, such as the ridge line patterns on the finger, the valleys between the ridges, etc., commonly known as minutiae, which are then converted to stored digital data. In order to get a fingerprint match for verification or authorization, biometric systems must find a sufficient number of minutiae patterns. This number varies across systems.

Behavioral Biometrics

Behavioral biometrics identify and measure human activities, such as keystroke dynamics, voice print, device usage, signature analysis, error patterns (accidentally hitting an “l” instead of a “k” on two out of every fifth transaction), etc. Such behavioral biometrics are typically used as an additional layer of security, along with other credential or biometric information.

Most physical biometric solutions systems authenticate the user only once and usually at the beginning of an action, such as logging into a device or opening a door. Behavioral biometric technology attempts to fill the gap of authentication in a scenario during an action.

For instance, the original user may provide his/her credentials to another person after the user has been successfully authenticated (akin to tailgating). In order to minimize such possibilities in this case, behavioral biometric solutions analyze users’ interactions with their devices, recording activities that vary from normal usage patterns.

Organizations Offering Biometric Solutions

Crossmatch – ‘Composite’ Biometric Authentication

Crossmatch claims to be a “risk-based composite authentication and biometric identity management” company. In 2014, it merged with Digital Persona, another biometric company, to launch its key biometric solution platform for enterprises called DigitalPersona Composite Authentication.

The platform offers the “broadest set of authentication factors,” including fingerprint scanning, face and voice recognition, and behavioral biometrics, such as keystroke, swipe and mouse action tracking, the company said. In November 2017, Crossmatch announced its partnership with BehavioSec , a Sweden-based behavioral biometrics company, which powers the behavioral biometric analyses functions of DigitalPersona.

In September 2017, Crossmatch partnered with Oxford Computer Group, a Microsoft Gold Partner that offers identity and security solutions. This announcement claims that the DigitalPersona software will be offered to Oxford’s Microsoft customer base.

Apart from the enterprise platform, the company also seems to offer a wide range of biometric solutions, most notably, fingerprint scanning and detecting solutions across various business sectors, including finance, government, law enforcement, retail, etc.

Tygart Technology – Facial Recognition from Videos

Tygart Technology said it provides video and photographic analysis as well as biometric recognition systems for state and federal government clients in the United States.

MXSERVER “will help prevent criminal and terrorist attacks from being carried out.” Facewatchis a London-based firm that uses the MXSERVER facial recognition platform to help businesses and police “tackle low-level crime.” The system supposedly alerts businesses when registered criminals enter the premises. It does so by matching the facial biometric information stored in a centralized watchlist.

Lately, Facewatch announced its facial recognition system installed in BRMalls in Brazil helped “capture 5 severe criminals in the very first 2 weeks of use.” That story – as well as a selection of other Facewatch testimonials – had been discussed in depth by American Security Today in October 2017. Facewatch is now utilizing MXSERVER as the facial recognition engine of its, though it is able to work with any method.

People with a specific interest of AI for criminal detection ought to check the prior post of ours titled AI for Crime Prevention and Detection – 5 Current Applications.

Onfido – Facial Biometrics

London-based Onfido is an internet digital verification platform for companies. Along with any other compliances & clearances, Onfido also utilizes skin biometrics, as an extra level of protection, to confirm particular individuals. The company said it utilizes machine learning know-how to confirm a user’s cross reference and identity it against international credit as well as watchlist databases.

The video below shows the usage of face biometrics on the Onfido mobile site, which appears to be incorporated with a banking platform. The volunteer is actually asked to confirm the identity of her that uses 2 measures. For starters, pictures of her driver’s license are actually scanned online.

The company has raised over sixty dolars million from great firms like Microsoft Ventures, Salesforce Ventures as well as Crunchfund. Much more recently, Crane Venture Partners invested $thirty million to fund the company’s R&D in machine learning technologies.

The company customers include ZipCar, Couchsurfing, Revolut and Square. Very recently, it launched its onboarding platform on the Salesforce AppExchange.

EyeLock – Iris Recognition

EyeLock said it offers “advanced iris authentication for the Internet of Things.” It’s a signature product, Nano NXT, which is an iris biometric recognition hardware. Nano NXT has a false acceptance rate (the likelihood of the biometric security system accepting an unauthorized user) of 1 in 1.5m in a single eye.

The company says it owns more than 75 patents for its proprietary biometric technology. It also cites various partners that use and resell its biometric solutions. Its most recent partnerships include STANLEY Security Solutions, ViaTouch Media and Central Security Distribution.

Fujitsu Frontech – Vein Recognition

Japan-based Fujitsu Frontech’s signature biometric solution is the PalmSecure Sensor, an authentication device that scans the veins in the palm without the user having to make contact with the device.

A 2015 animated video describes this technology and just how the biometric info is kept in the database.

In May 2017, the business announced that Fujitsu Korea and Fujitsu Frontech partnered to present the vein recognition formula to Korea’s Lotte Card Co Ltd to facilitate a cashless and cardless transaction system. “PalmSecure doesn’t save palm vein information in the shape of an image but only it changes the vein pattern information into information which can’t be deciphered, and then encrypts that data,” the company said.

Decreased hemoglobin within the vein assimilates near infrared rays which makes it possible to “distinguish vein patterns which differ from individual to person,” the firm added. Additionally, since the vein patterns don’t change, as do other biometric elements, this method involves just an one time registration.

As of March thirty one, 2017, aproximatelly 770,000 PalmSecure products have been delivered to sixty countries, and over seventy million folks make use of this particular biometrics device, Fujitsu believed.

BehavioSec – Behavioral Biometrics

Sweden-based BehavioSec said it uses continuous machine learning to authenticate users based on their behavior patterns, such as pressure, gyroscope, button hit zone, motion, accelerometer, mouse actions, etc.

BehavioSec’s demo video explains how this technology works:

In 2012, the U.S. Defense Advanced Research Projects Agency invested in its technology, the company said. Nevertheless, it doesn’t mention for just how long the funding was on process or maybe just how much cash was required. BehavioSec additionally said it secures greater than five billion transactions a year, though it didn’t offer info on the kinds of transactions.

Recently, the BehavioSec technology has been integrated into Crossmatch’s DigitalPersona platform.

Future Revenue Forecasts in Biometrics

Based on a 2017 Tractica report, biometrics hardware as well as software revenue will develop to $15.1 billion globally by 2025, with a CAGR of 22.9 %. The report additionally predicts that the snowball biometrics revenue from 2016 to 2025 will total $69.8 billion.

The report analyzes 142 pick cases as well as infers that probably the largest revenue segments of biometrics will be fingerprint recognition, voice recognition, face recognition and iris recognition. Probably The largest program markets for the biometric technologies, based on the report, will be consumer, healthcare, finance, enterprise-level as well as government

The iris recognition sector is going to grow from $676.6 million in 2016 to $4.1 billion by 2025, according to the report. Throughout this 10 year period, worldwide shipments of iris recognition products will boost from 10.7 million units to 61.6 million models annually, with 277.4 zillion snowball shipments.

International enterprise biometrics revenue is going to reach $1.7 billion by 2024, with a snowball revenue of $7.9 billion from 2015 2024, at a twenty eight % CAGR, according to a 2016 Tactical report. Healthcare as well as finance industries show probably the most possible for revenue development within the 10 year time of 2015 2024, the report included.

Source: Radhika Madhavan, emerj.com