Machine learning in finance might work magic, although there’s no secret powering it (well, perhaps just a bit of bit). Nevertheless, the good results of machine learning task depends much more on creating effective infrastructure, collecting ideal datasets, and putting on the proper algorithms.

Machine learning is actually making considerable inroads within the financial services sector. Let us see why financial companies must care, what answers they could put into action with AI as well as machine learning, and just how exactly they are able to use this technology.

Definitions

We are able to define machine learning (ML) being a subset of information science that makes use of statistical models to bring insights as well as whip predictions. The chart below describes how AI, information science, as well as machine learning are actually related. For the benefit of simplicity, we concentration on machine learning within this particular post.

The secret about machine learning treatments is actually they learn from experience without simply being explicitly programmed. In order to put it just, you have to pick the designs and supply them with information. The unit then automatically changes the parameters of its to enhance results.

Data scientists train machine learning models with existing datasets and then apply well-trained models to real-life situations.

The unit runs as a background progression and also offers results easily based on just how it was trained. Data scientists are able to retrain designs as frequently as necessary to keep them effective and up-to-date. For example, our client Mercanto retrains machine mastering models each day.

In general, the more data you feed, the more accurate are the results. Coincidentally, enormous datasets are very common in the financial services industry. There are petabytes of data on transactions, customers, bills, money transfers, and so on. That is a perfect fit for machine learning.

As the technology evolves and the best algorithms are open-sourced, it’s hard to imagine the future of the financial services without machine learning.

That said, most financial services companies are still not ready to extract the real value from this technology for the following reasons:

- Businesses often have completely unrealistic expectations towards machine learning and its value for their organizations.

- R&D in machine learning is costly.

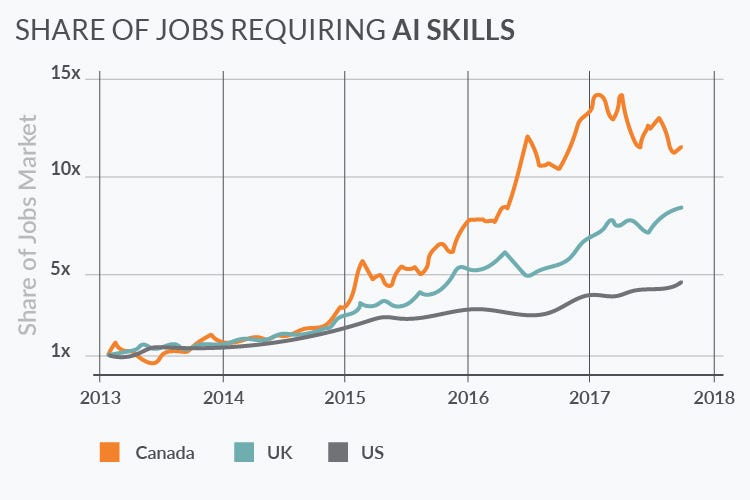

- The shortage of DS/ML engineers is another major concern. The figure below illustrates an explosive growth of demand for AI and machine learning skills.

- Financial incumbents are not agile enough when it comes to updating data infrastructure.

We will talk about overcoming these issues later in this post. First, let’s see why financial services companies cannot afford to ignore machine learning.

Why consider machine learning in finance?

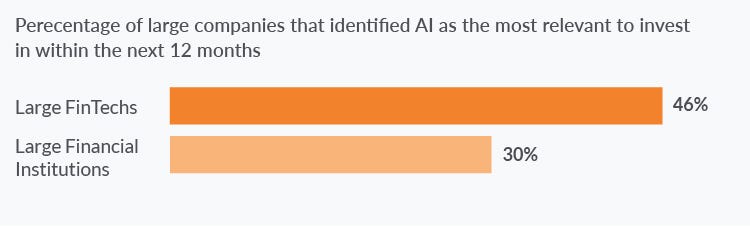

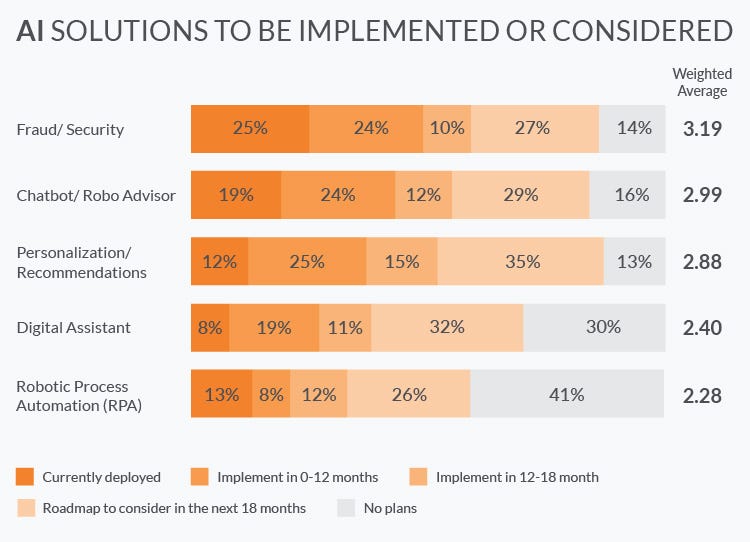

Despite the challenges, many financial companies already take advantage of this technology. The figure below shows that financial services’ execs take machine learning very seriously, and they do it for a bunch of good reasons:

- Reduced operational costs thanks to process automation.

- Increased revenues thanks to better productivity and enhanced user experiences.

- Better compliance and reinforced security.

There is a wide range of open-source machine learning algorithms and tools that fit greatly with financial data. Additionally, established financial services companies have substantial funds that they can afford to spend on state-of-the-art computing hardware.

Tanks to the quantitative nature of the financial domain and large volumes of historical data, machine learning is poised to enhance many aspects of the financial ecosystem.

That is why so many financial companies are investing heavily in machine learning R&D. As for the laggards, it can prove to be costly to neglect AI and ML.

What are machine learning use cases in finance?

Let’s take a look at some promising machine learning applications in finance.

Process Automation

Process automation is one of the most common applications of machine learning in finance. The technology allows to replace manual work, automate repetitive tasks, and increase productivity.

As a result, machine learning enables companies to optimize costs, improve customer experiences, and scale up services. Here are automation use cases of machine learning in finance:

- Chatbots

- Call-center automation.

- Paperwork automation.

- Gamification of employee training, and more.

Below are some examples of process automation in banking:

JPMorgan Chase launched a Contract Intelligence (COiN) platform that leverages Natural Language Processing, one of the machine learning techniques. The solution processes legal documents and extracts essential data from them. Manual review of 12,000 annual commercial credit agreements would typically take up around 360,000 labor hours. Whereas, machine learning allows to review the same number of contracts in a just a few hours.

BNY Mello integrated process automation into their banking ecosystem. This innovation is responsible for $300,000 in annual savings and has brought about a wide range of operational improvements.

Wells Fargo uses an AI-driven chatbot through the Facebook Messenger platform to communicate with users and provide assistance with passwords and accounts.

Privatbank is a Ukrainian bank that implemented chatbot assistants across its mobile and web platforms. Chatbots sped up the resolution of general customer queries and allowed to decrease the number of human assistants.

Security

Security threats in finance are actually increasing along with the increasing selection of transaction, subscribers, as well as third party integrations. And machine learning algorithms are actually excellent at detecting frauds.

For example, banks are able to make use of this technology to observe a huge number of transaction parameters for each account in time that is real. The algorithm examines each measures a cardholder takes as well as assesses in case an attempted activity is actually characteristic of that specific user. Such item spots fraudulent conduct with top accuracy.

If the method identifies suspicious account conduct, it is able to ask for additional identification from the end user to confirm the transaction. Or perhaps even block the transaction entirely, in case there’s at least ninety five % likelihood of it becoming a fraud. Machine learning algorithms need only a couple of seconds (or maybe perhaps split seconds) to evaluate a transaction. The speed will help to avoid frauds in time that is real, not merely notice them after the crime was already committed.

Financial monitoring is one more security use situation for machine learning in financial. Data scientists are able to teach the product to identify a lot of micropayments as well as flag such cash laundering methods as smurfing.

Machine learning algorithms can substantially enhance network security, also. Data scientists train a method to area as well as isolate cyber threats, as printer learning is actually next to not one in examining a huge number of parameters and real time. And chances are actually that technology will provide power to by far the most complex cyber security networks in probably the nearest long term.

Adyen, Payoneer, Paypal, Stripe, and Skrill are some notable fintech companies that invest heavily in security machine learning.

Underwriting and credit scoring

Machine learning algorithms fit perfectly with the underwriting tasks that are so common in finance and insurance.

Data researchers train models on a huge number of client profiles with thousands of information entries for every client. A well trained method can then perform the exact same underwriting and credit scoring things in the real life environments. Such scoring engines help man employees perform much quicker and more accurately.

Insurance companies and banks have a big selection of historical customer data, so that they could make use of these entries to instruct machine learning models. On the other hand, they are able to leverage datasets produced by large telecom or maybe energy companies.

For instance, BBVA Bancomer is collaborating with an answer credit scoring platform Destacame. The bank is designed to boost credit access for people with thin credit history within Latin America. Destacame accesses bill payment info from energy companies through amenable APIs. Using bill transaction behavior, Destacame creates a credit score for a consumer and directs the outcome to the bank.

Algorithmic trading

In algorithmic trading, machine learning helps to make better tradingdecisions. A mathematical model monitors the news and trade results in real-time and detects patterns that can force stock prices to go up or down. It can then act proactively to sell, hold, or buy stocks according to its predictions.

Machine learning algorithms can analyze thousands of data sources simultaneously, something that human traders cannot possibly achieve.

Machine learning algorithms help man traders squeeze a slim edge over the marketplace average. And, given the huge volumes of trading functions, that little advantage usually translates into substantial profits.

Robo-advisory

Robo-advisors are now commonplace in the financial domain. Currently, there are two major applications of machine learning in the advisory domain.

Portfolio management is an internet wealth management service which makes use of statistics and algorithms to allocate, control as well as enhance clients’ assets. Users enter the present financial assets of theirs and objectives, point out, saving a million bucks by the era of fifty. A robo advisor then allocates the existing assets across investment opportunities depending on the threat tastes and the desired objectives.

Recommendation of financial products. Many internet insurance services use robo advisors to suggest personalized insurance plans to a specific user. Customers choose robo advisors over personal financial advisors as a result of lower costs, and also personalized as well as calibrated suggestions.

How to make use of machine learning in finance?

In spite of all of the benefits of AI as well as machine learning, including businesses with deep pockets usually have a tough time extracting the true value from this particular technology. Financial services incumbents wish to exploit the special possibilities of printer learning but, reasonably, they’ve a vague idea of exactly how information science works, and how you can use it.

Time and again, they encounter similar challenges like the lack of business KPIs. This, in turn, results in unrealistic estimates and drains budgets. It is not enough to have a suitable software infrastructure in place (although that would be a good start). It takes a clear vision, solid technical talent, and determination to deliver a valuable machine learning development project.

Once you’ve a great knowledge of exactly how this technology is going to help to attain business goals, proceed with concept validation. This’s a process for data scientists. The idea is investigated by them and enable you to formulate practical KPIs and make practical estimates.

Note that you need to have all the data collected at this point. Otherwise, you would need a data engineer to collect and clean up this data.

Depending on a particular use case and business conditions, financial companies can follow different paths to adopt machine learning. Let’s check them out.

Forgo machine learning and focus on big data engineering instead

Often, financial companies start their machine learning projects only to realize they just need proper data engineering. Max Nechepurenko, a senior data scientist at N-iX, comments:

When developing a [data science] solution, I’d advise using the Occam’s razorprinciple, which means not overcomplicating. Most companies that aim for machine learning in fact need to focus on solid data engineering, applying statistics to the aggregated data, and visualization of that data.

Merely implementing statistical models to refined and well structured details will be sufficient for a bank to identify a variety of bottlenecks as well as inefficiencies in its activities.

What exactly are the instances of such bottlenecks? That can be queues at a particular branch, repetitive responsibilities that could be removed, inefficient HR tasks, flaws of mobile banking app, etc.

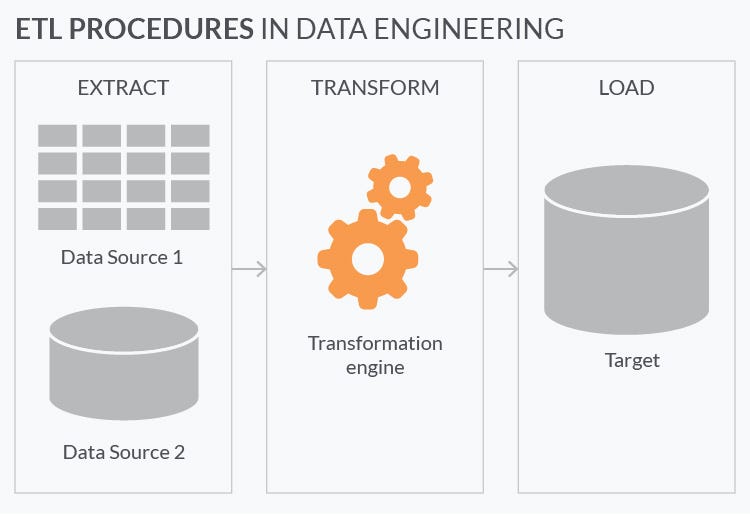

What is more often, probably the biggest part of any information science project comes right down to establishing an orchestrated environment of platforms which collect siloed information from thousands of sources as CRMs, reporting more, spreadsheets, and software.

Before using some algorithms, you have to have the information properly organized as well as cleaned up. Only then, you are able to additionally turn the information into insights. In reality, ETL (extracting, changing, and loading) along with additional cleaning of the information account for around eighty % of this printer mastering project ‘s period.

Use third-party machine-learning solutions

Even in case your business makes a decision to make use of machine learning in the upcoming project of its, you don’t always have to create models and algorithms new.

Most machine learning projects cope with issues which have actually been resolved. Tech giants as Google, IBM, Amazon, and Microsoft sell machine learning software program as a service.

These out-of-the-box solutions are actually taught to resolve a variety of business tasks. In case your project covers the identical use cases, can you trust the team of yours is able to outperform algorithms coming from these tech titans with colossal R&D facilities?

One great example is actually Google’s multiple plug-and-play suggestion strategies. The application is true to different domains, and it’s only rational to determine in case they meet to your business situation.

A computer learning engineer is able to carry out the process focusing on your unique details and business domain. The specialist must extract the information from various sources, change it to slip for this specific phone system, receive the outcomes, and imagine the findings.c

The trade-offs are lack of control over the third-party system and limited solution flexibility. Besides, machine learning algorithms don’t fit into every use case. Ihar Rubanau, a senior data scientist at N-iX comments:

A universal machine learning algorithm does not exist, yet. Data scientists need to adjust and fine-tune algorithms before applying them to different business cases across different domains.

So if an existing solution from Google solves a specific task in your particular domain, you should probably use it. If not, aim for custom development and integration

Innovation and integration

Creating a machine learning formula from scratch is among probably the riskiest, most costly and time consuming options. Nevertheless, this might be the only way to use ML technology to several industry situations.

Machine learning research as well as development targets a distinctive need in a specific niche, and it needs an in depth investigation. If there aren’t any ready-to-use remedies which were put together to resolve those particular issues, third party machine learning program is apt to create incorrect results.

Still, you will probably need to rely heavily on the open source machine learning libraries from Google and the likes. Current machine learning projects are mostly about applying existing state-of-the-art libraries to a particular domain and use case.

At N-iX, we have identified seven common traits of a successful enterprise R&D project in machine learning. Here they are:

- A clear objective. Before collecting the information, you want at least several basic comprehension of the results you wish to accomplish with AI as well as machine learning. At the first stages of the task, data scientists can help you turn the thought into actual KPIs.

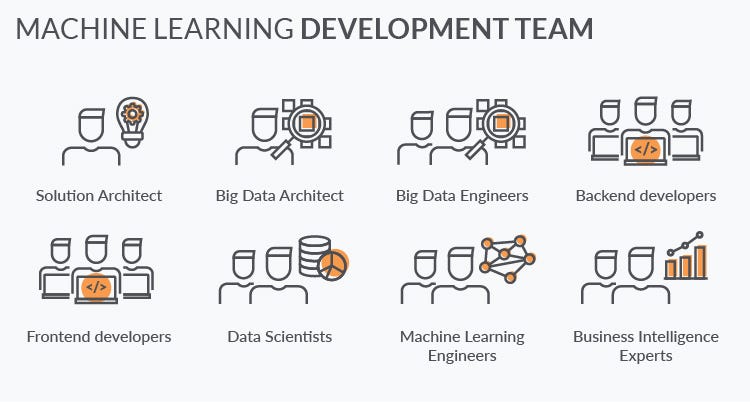

- Robust structure design of the machine learning remedy. You want a seasoned software architect to perform this job.

- Appropriate big data engineering ecosystem (based on Apache Hadoop or Spark) is a must have. It allows collecting, integrate, shop, and process enormous quantities of information from many siloed information energy sources of the financial services businesses. Big data architect and large data engineers are accountable for building the ecosystem.

- Running ETL procedures (extract, transform, and load) on the newly created ecosystem. A big data architect or a machine learning engineer perform this task.

- The final data preparation. Besides data transformation and specialized clean up, data scientists might have to perfect the information even more to make it ideal for a particular business case.

- Applying appropriate algorithms, creating designs depending on these algorithms, fine tuning versions, and retraining versions with new details. These duties are performed by data scientists and machine learning engineers.

- Lucid visualization of the insights. Business intelligence specialists are accountable for that. Besides, you might need frontend developers to produce dashboards with user-friendly UI.

Small tasks may require substantially less work and a significantly smaller staff. For example, several R&D projects deal with tiny datasets, therefore they probably do not have complex big data engineering. In any other instances, there’s no requirement in complex dashboards or maybe any information visualization at all.

Key takeaways

- Financial incumbents most frequently use machine learning for process automation and security.

- Before collecting the data, you need to have a clear view of the results you expect from data science. There is a need to set viable KPIs and make realistic estimates before the project’s start.

- Many financial services companies need data engineering, statistics, and data visualization over data science and machine learning.

- The bigger and cleaner a training dataset is, the more accurate the results a machine learning solution produces.

- You can retrain your models as frequently as you need without stopping machine learning algorithms.

- There is no universal machine learning solution to apply to different business cases.

- The R&D in machine learning is costly.

- Tech giants like Google create machine learning solutions. If your project concerns such use cases, you cannot expect to outperform algorithms from Google, Amazon, or IBM.

- Source: Konstantin Didur, towards data science